What to Note Down in Your Trading Journal: A Guide for Crypto Day Traders

Keeping a trading journal is crucial for any serious crypto day trader. It allows you to track your trades, analyze your performance, and refine your strategies. But what exactly should you note down in your trading journal, and how do you ensure it's effective? This article will provide a comprehensive guide on how to write a trading journal and highlight the benefits of using an automated tool like TraderMake.Money.

When writing a trading journal, including detailed information about each trade is essential. Here are the key elements you should note down:

1. Date and Time

Recording the date and time of each trade is essential for keeping track of when you made your trading decisions. This information helps you correlate your trades with market events or specific time-based patterns. Knowing the exact timing can also assist in understanding the context of your trades and identifying trends or habits related to particular times of the day or week.

2. Asset

Note the specific cryptocurrency or asset you traded. This helps you track your performance across different assets and identify which ones you trade most successfully. Keeping a record of the assets also aids in understanding market conditions for each asset type and can help in diversifying your trading portfolio.

3. Entry and Exit Points

Record the price at which you entered and exited the trade. This helps in calculating your profit or loss for each trade. Knowing your entry and exit points is crucial for evaluating the effectiveness of your trading strategy and timing. It allows you to analyze whether you are buying and selling at optimal points and can highlight areas for improvement.

4. Position Size

Document your position size: how much of the asset you bought or sold. Position size is a critical factor in risk management. By keeping track of it, you can analyze how different position sizes impact your overall profitability and risk exposure. It also helps in maintaining consistency and discipline in your trading approach.

5. Trade Direction

Indicate whether you went long (buy) or short (sell) on the asset. This helps assess your trading strategy and understand your bias towards certain market conditions. Knowing your trade direction can also reveal patterns in your decision-making process and help you identify if you are more successful in bullish or bearish markets.

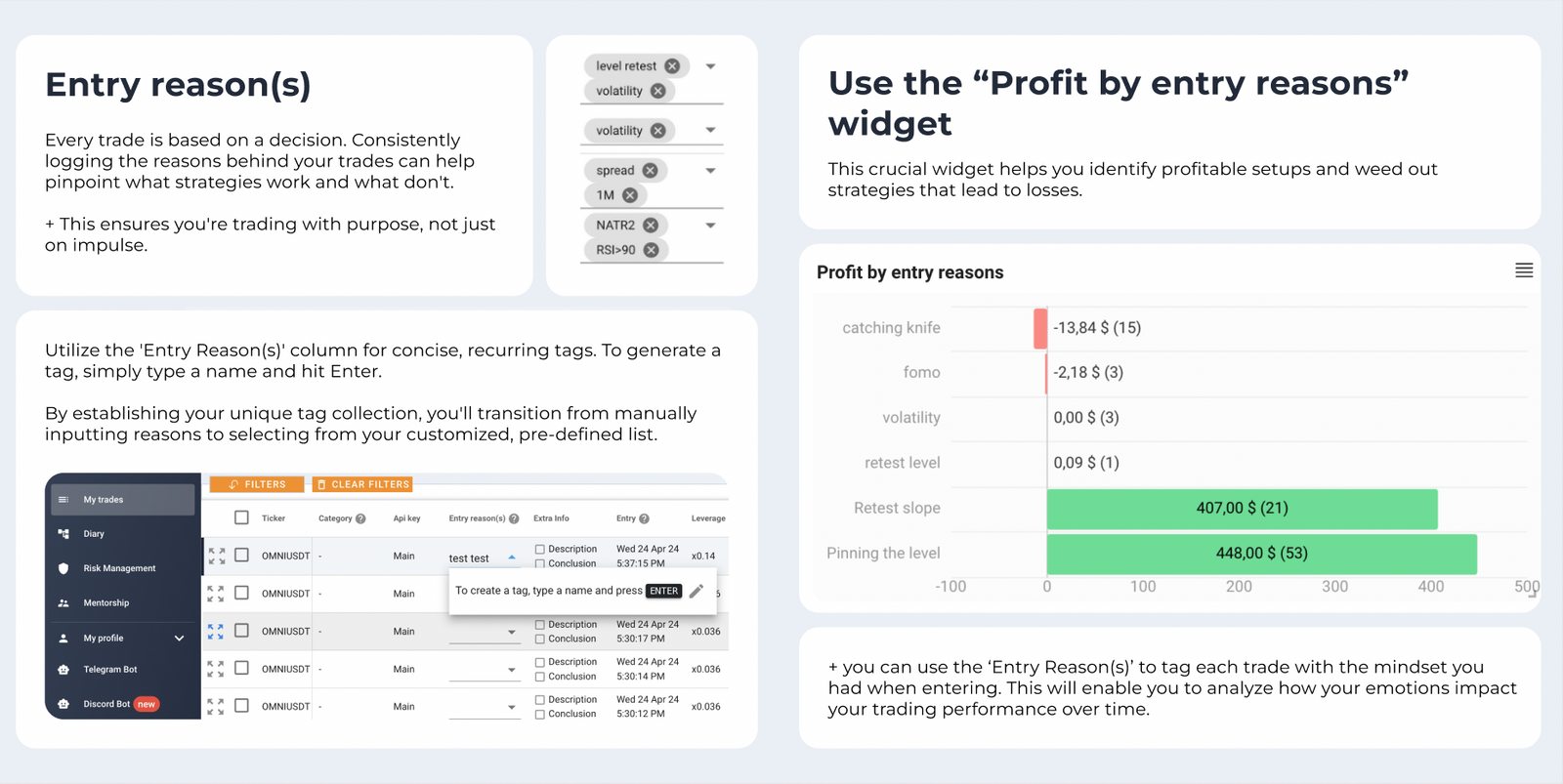

6. Reason for Trade

Write down the rationale behind your trade. This could be based on technical analysis, market news, or other factors influencing your decision. Documenting the reasons for your trades helps you evaluate the effectiveness of your analysis and decision-making process. It also provides insights into which types of analysis work best for you and can guide future trading decisions.

7. Profit/Loss

Calculate and note the profit or loss you made on each trade. This helps in assessing your overall performance and understanding your success rate. Keeping track of your earnings and losses allows you to see how well you are doing over time and can highlight areas where you need to improve or adjust your strategy.

8. Emotions and Observations

Record your emotions and any observations during the trade. This can help you identify emotional biases and improve your trading psychology. Emotions play a significant role in trading, and being aware of them can help you manage them better. Observations about market conditions, your mental state, or external factors can also provide valuable context for your trades.

9. Screenshot

Including a screenshot of the chart at the time of the trade can be very helpful for future reference. Visual documentation of your trades allows you to see the technical setup and market conditions at the time of your decision. This can be useful for reviewing and learning from past trades, identifying patterns, and refining your strategies.

How to Write a Trading Journal Effectively

Writing a trading journal manually can be time-consuming and prone to errors. An automated trading journal can streamline this process and offer additional benefits. Here’s why using an automated tool like TraderMake.Money is advantageous:

- Accuracy: Automated journals ensure that all details of your trades are recorded accurately and consistently, reducing the risk of human error.

- Time-Saving: Automated tools save you time by automatically logging your trades and related data, allowing you to focus more on trading and analysis.

- Comprehensive Analysis: Automated journals provide detailed and sophisticated analysis. They can generate charts, graphs, and reports that help you visualize your performance and identify critical trends.

- Data-Driven Insights: Using an automated journal gives you access to data-driven insights that can help you make informed trading decisions. These insights are based on a comprehensive analysis of your trading history and market data.

Start Journaling Your Trades Right Away

Join for FREETraderMake.Money: An Ideal Automated Trading Journal

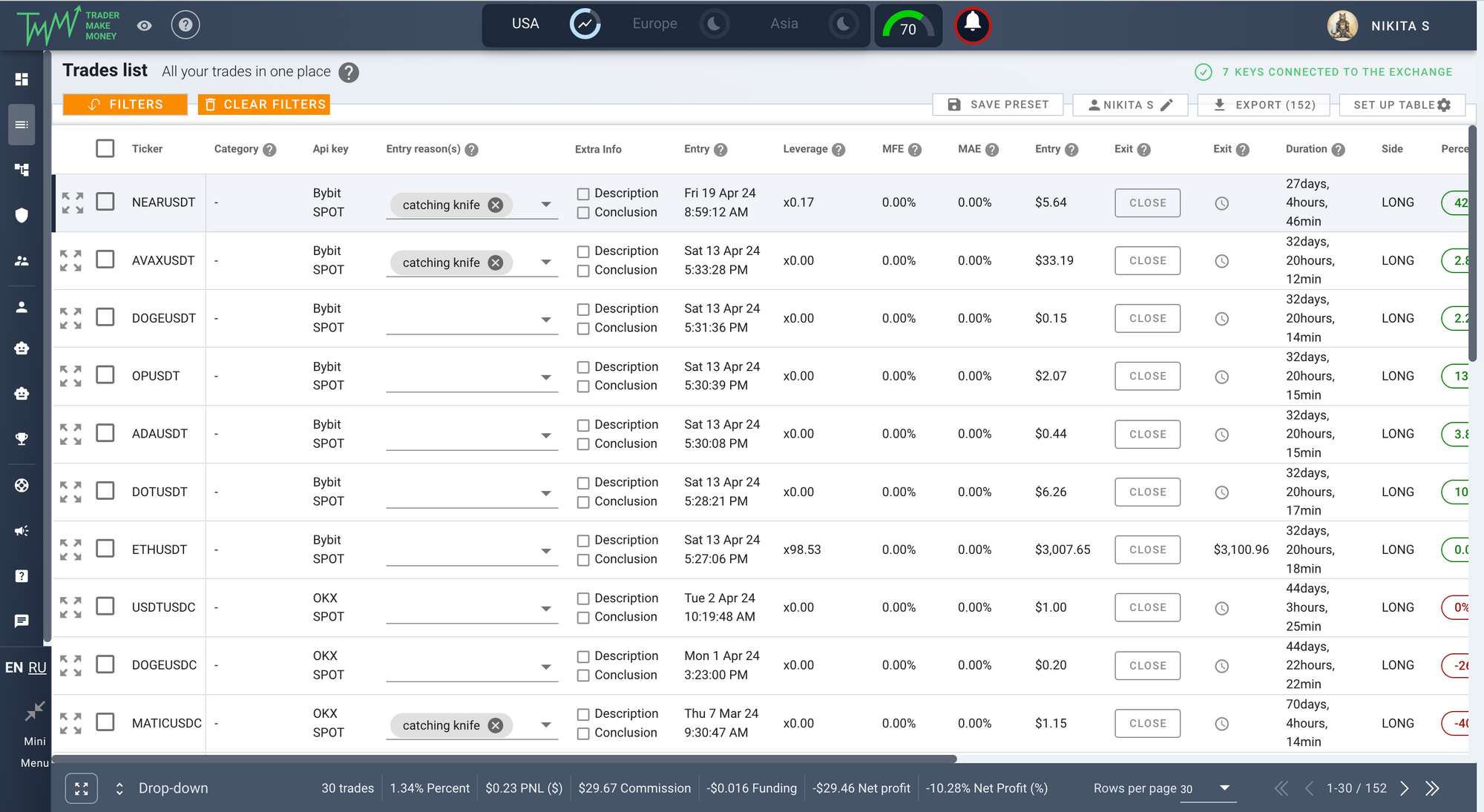

TraderMake.Money is a premier example of an automated trading journal explicitly designed for crypto day traders. Here are some of its key features:

- Automatic Trade Logging: TraderMake.Money automatically records your trades, including entry and exit points, trade size, and other relevant details. This ensures your journal is always up-to-date and accurate.

- Detailed Analytics: The platform provides a comprehensive analysis of your trading activity. You can view detailed reports, charts, and graphs that highlight your performance and help you identify patterns and trends.

- Strategy Refinement: By analyzing your trading history, TraderMake.Money helps you refine your strategies. It offers insights into what’s working and what’s not, enabling you to make data-driven adjustments to your trading approach.

- User-Friendly Interface: The tool is designed to be user-friendly, making it easy for traders of all experience levels to use. Its intuitive interface ensures you can quickly access the information you need.

- Analytical Widgets: The platform offers various analytical widgets that provide real-time data and performance metrics. These widgets can be customized to show the information most relevant to your trading style and objectives.

- Risk Management: TraderMake.Money includes risk management features that help you monitor and control your exposure. You can set alerts for when your trades exceed predetermined risk thresholds, helping you manage your risk more effectively.

- Telegram Bot Integration: You can connect your profile with the bot and receive notifications when your orders are filled, when trades are closed, and view daily or weekly reports. You can also see your open positions and share them with other Telegram users.

Conclusion

Writing a detailed and accurate trading journal is essential for any crypto day trader. You can track your performance and refine your strategies by noting key elements such as date and time, asset, entry and exit points, position size, trade direction, reason for trade, profit/loss, and emotions. Using an automated trading journal like TraderMake.Money can further enhance your journaling process by ensuring accuracy, saving time, and providing comprehensive analysis. If you’re serious about improving your trading, consider making the switch to an automated trading journal today.